MEET KENNY RUSHING

I'm Kenny Rushing, also known as the Real Estate OG. Over the past 20 years I've flipped more than 2,000 houses. During the same period, I participated in over $150 million in real estate deals. Many of these transactions were done without using any of my own personal cash or credit. This level of success is impressive by anyone’s standard. I’m here to tell you that there’s enough wealth to be gained through real estate investments for all of us. I can teach you my tried and true methods and strategies so that you too can make a killing in this lucrative field. That's why they call me the Real Estate OG.

THE REAL ESTATE O.G. KENNY RUSHING

20 YEARS OF #NOFAKENESS !!

You Never Forget Your First Investment Property

Like your first love, you never forget your first investment property. Mine was 310 21st Ave S St. Petersburg, FL. After giving it some well-needed ‘TLC’, I sold that baby and made $37,500 on my first deal. When I endorsed the check and deposited into my skimpy checking account, I felt like I hit the jackpot. I was not wrong. It was my initial confirmation that this business really works.

Kenny's First Mansion

In 2001 I purchased this house for $76,000. The deal was funded by a local hard money lender. After I completed the renovations the property was worth $425,000. I did a Re-fi/ cash out and walked away with $150,000 to reinvest into more properties.

My First Wholesale Real Estate Deal

In 2002 I got this property under contract for $115,000. My intentions were to rehab and rent it for cash flow but my hard money lender refused to fund the deal because it was more than 4 units. I decided to create a flyer to market the property for $135,000. I passed out the flyers at the local foreclosure auction where there were a lot of cash buyers bidding on homes. Through this very fundamental marketing method I found a buyer and made an $20,000 assignment fee, and that's how my wholesale career began!

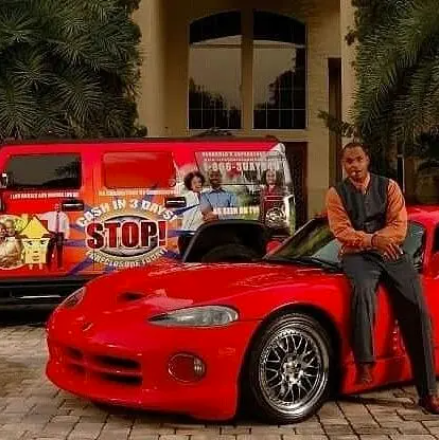

CASH IN 3 DAYS For Your House

Back in 2003 it typically took most investors 15-45 days to close a real estate deal depending on whether they were getting a hard money loan or obtaining conventional financing. One Tuesday I received a call from a motivated seller who owned her home free and clear. She offered it to me for $12,500 but I had to close by that Friday. O shucks, I wasn’t sure if I could pull that off! I quickly called my title company to see if they could close that fast, and what do you know, they closed the deal that Thursday! That's when I came up with "Cash In 3 Days for Your House" marketing model. If I could offer the same quick turnaround that I offered this seller to the general public my business would take off. When word got around town that Kenny Rushing could close deals in days instead of weeks, my phone began to ring off the hook with motivated sellers who were begging me to buy their houses if I could guarantee a quick closing. Once again, I stumbled into success!

A Traffic Billboard Is A Great Way To Get People's Attention !

In 2004, on the strength of the "Cash in 3 Days for Your House" campaign, my company, The Rehabbers Superstore was gaining momentum. I embarked on a mass marketing campaign using print, television, radio, bus stop benches and billboards. Through this multi-media campaign, I was able to wholesale 10-50 houses per month.

The House Hustling Movement

In early 2004, my company experienced a growth spurt. I was attracting more business than I could handle and my profit margin was multiplying exponentially. While I enjoyed the success, I felt a tremendous responsibility to help others, especially those in communities of color to learn the strategies that I had used to extricate myself from grips of poverty. To accomplish this desire, I launched the ‘House Hustling Movement’ and began hosting free real estate seminars and bus tours in the city of Tampa. By popular demand the movement soon spread to many cities across the country.

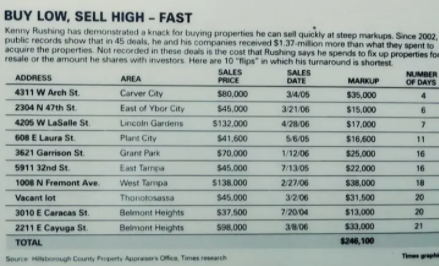

BUY LOW, SELL HIGH - FAST

By 2006, I was creating a massive buzz which attracted the attention of both local and national media. This is an article from a local newspaper that began to hear about my story and wanted to find out if it was really making millions of dollars by wholesaling houses. This is what their findings concluded:

Welcome To Rushing Mansion #2

By 2007 my partners and I were making an average of $250,000 to $750,000 per month through wholesaling houses. I decided to challenge myself by building a mansion from the ground up. My objective was to build it, and then flip it for a handsome $2million profit…then came the wicked real estate crash of 2008. To save my investment, I needed to postpone my plans and move into it until the market recovered.

New Jack Investor Launch

In 2008 I launched the New Jack Investor Home Study course to an eager audience. New Jack was among the very first real estate programs to be sold on the internet. We did a 1-day launch and sold nearly $100,000 in programs in a single day. We topped it off by having a lavish party at the mansion. Ten years later people in the industry still talk about that party!

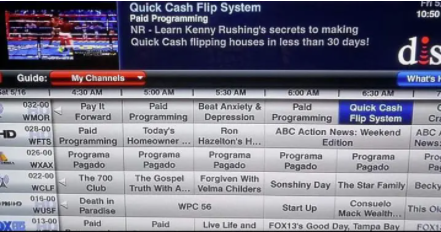

$1 Deal Maker TV Informercial

In 2009 I co-partnered with infomercial pioneer Russ Whitney to do a live TV spot that introduced my $1 Deal Maker wholesale strategy to viewers. This opportunity led me to produce several more TV shows for myself as well as for other real estate experts.

Mount Pleasant Black Diamond Award

In 2010, I was honored to receive one of many awards for my philanthropic work in the Tampa Bay community. This award was from Mount Base Standard Base Middle School where I donated money to help inner - city youth. I also paid to have Tiny 'Debo' Lister come speak to the youth at the school. There isn't a better feeling than when you can help others reach their goals!

The Kenny Rushing School Of Real Estate Investing LLC.

In 2011, I decided to start the Kenny Rushing School Of Real Estate Investing, LLC to teach people how to successfully invest using my real estate strategies. Over the last 10 years we have taught thousands of students at our seminars, workshops and phone coaching how to successfully invest in real estate for profit.

Country Wood Apartment Homes

In 2012, I began diversifying and buying distressed assets from banks at bargain basement prices. This is a 351 unit apartment building I bought for $890,000 only a few months later I flipped it and walked away with a quick $250,000 profit.

Rush Capital Fund LLC

In 2013 I created a real estate fund to raise capital for the purpose of purchasing bulk REO and mortgage notes at bargain basement prices from banks and servicing companies that were looking to liquidate their toxic assets. This initiative led me to create my 'Bulk REO Trader' home study course that teaches students how to invest in Bulk REOs and Mortgage Notes.

The Best Way To Build Wealth Is Buying Long Term Rentals

In 2014, after 14 years as a successful real estate investor I started to realize that I didn't want to be a house flipper at the age of 70 or 80, so I began to place more emphasis on buying rental properties to create a consistent and predictable cash flow for myself. For my own personal circumstances and my long-term goals and objectives, this was the best decision. I believe that it is wise to pursue a progressive strategy of wholesaling or fixing & flipping properties for quick cash profit, then moving on to park that money into income producing properties in order to create a steady monthly cash flow to pay your bills and sit back and relax.

Kenny's Second National TV Infomercial

In 2015 I produced my second national TV infomercial for the Kenny Rushing School of Real Estate Investing. The show taught aspiring real estate investors how to get started in real estate investment business without cash or credit. To do so they would simply my wholesaling strategy. The informercial was a phenomenal success and I'm happy to report that to we were able to help many people realize their dream of learning how to successfully invest in real estate.

Flexing to the Market

In 2016 the banks began to experience a resurgence in their mortgage profit margins. 'Toxic Assets' that could be bought in bulk for bargain basement prices were becoming scarce. I had to adjust to the prevailing market so once again I began buying properties in my local market from private sellers and at the foreclosure auctions. We continued to build our rental portfolio but we also began to fix and flip properties. Our average profit was $60,000 per flip, and we quickly ramped up to rehabbing 15-20 houses at a time.

Welcome to Rushing Mansion #3

In 2012 I purchased the 14,750 sq. ft. Rushing Mansion #3 from a builder who had it on the market for almost 2 years. I purchased it for $640,00 while the real estate market was at an all-time low. My goal was to hold on to the property for 5-7 years and sell it for a huge profit when the market recovered. That is exactly what happened, and when the market recovered, I flipped it for $1.5million.

Grocery Stores

In 2018 I began to diversify my holdings more by investing in gas stations, grocery stores and other commercial assets. We are currently teaching our students asset diversification strategies in order to mitigate their risk.

The Rushing Wedding

In 2019 with close friends and family in attendance, I married the love of my life, Monyetta Jones at the Powel Crosley Estate in Sarasota, FL. We share one child together Kadesh Rushing.

Welcome To Rushing Mansion #4

In 2020 my wife Monyetta and I bought Rushing Mansion #4, a 7,200 square foot mansion that sits on 2-acres of land. With this deal we added over $1million to our net worth after only 6 months of renovations. We bought the mansion for $650,000 from a motivated seller who inherited the property from his parents. We are almost complete with the renovations and it will be worth $1.8million when the work is complete. We are now preparing to capitalize on a major real estate market correction that is imminent post COVID-19. Undoubtedly, there will be an abundance of great deals to come and we are currently raising the capital to fund these deals when they hit our desk.